17 3 Cash Flows from Operating Activities: The Indirect Method Financial Accounting

Content

Indirect cash flow statements are even easier to create if you use accounting software that helps track your income and expenses. IAS 7 Statement of Cash Flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements. In these cases, revenue is recognized when it is earned rather than when it is received.

Following is the conclusion of our interview with Robert A. Vallejo, partner with the accounting firm PricewaterhouseCoopers. The Lili Visa® Business Debit Card is issued by Choice Financial Group, Member FDIC, pursuant to a license from Visa U.S.A. Hannah Donor is a freelance copywriter and social media strategist with 5+ years of experience helping small businesses authentically curate the written word to reach and inspire their target market. It’s also compliant with both generally accepted accounting principles (GAAP) and international accounting standards (IAS). Each method has its own advantages and disadvantages that it’s important to be aware of when making your decision. Despite the simplicity and historical preference for the indirect method among finance professionals, there are some drawbacks to this method.

PART 1 – An Overview of the Cash Flow Statement Indirect Method

If balance sheets of two periods are compared side by side and there is a difference in the values of its non-current assets, then it means that there has been an investing activity within the period. Using the indirect method to prepare a cash flow statement is simpler than the direct method, as it relies on existing financial documents. The direct method requires performing reconciliation in order to determine what has been paid and what is currently unpaid, making the cash flow statement preparation more complex and time-consuming. Since most large companies use accrual accounting, most also use the indirect method of cash flow accounting. Typically, as a company grows, it becomes increasingly difficult to use the direct method of cash flow accounting. Since the calculation of cash-in-cash-out is straightforward, the direct accounting method uses the same simple formula as the net cash flow calculation, but applies it to the operating cash flows.

- You can take a look at how they differ as well as their advantages and disadvantages to help you decide which is right for your business.

- However, there will be scenarios where it will be advantageous to choose one over the other.

- You will find sample IFRS statements of cash flows in our Model IFRS financial statements.

- The cash would be reported in the investing section as proceeds from the sale of a long term asset.

- Companies tend to prefer the indirect presentation to the direct method because the information needed to create this report is readily available in any accounting system.

- Asset purchases and sales are also considered investments, and the activity surrounding these actions is also considered investing activity.

But there are several ways in which these can be put together, which may give different figures. Understanding the difference between direct and indirect cash flow reporting and which will be better-suited to your business is vital in ensuring your financial reporting is accurate and relevant. If companies prefer to use the direct method for internal reporting, they’d still have to create indirect method cash flow statements for reporting purposes. Using the indirect method helps the finance department avoid doing double the work when generating cash flow statements.

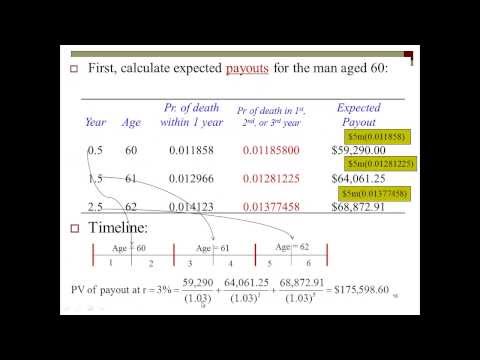

Accrued Revenue Affecting Net Income

A cash flow statement is important for internal purposes, as it enables you to evaluate the financial health of your business and can help guide strategy. A CFS also serves an important purpose externally, like demonstrating your business’s ability to pay debts and expenses to potential investors or lenders. Since the indirect method is based on accrual accounting and the income statement, there may be some inconsistencies and inaccuracies when it comes to the timing of actual cash inflows or outflows.

What are the 3 types of cash flows?

There are three cash flow types that companies should track and analyze to determine the liquidity and solvency of the business: cash flow from operating activities, cash flow from investing activities and cash flow from financing activities. All three are included on a company's cash flow statement.

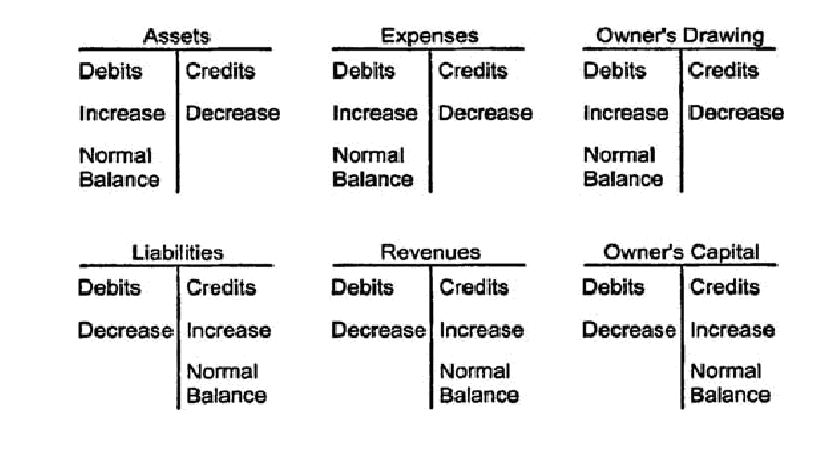

Thus, when accounts payable increases, cost of goods sold on a cash basis decreases (instead of paying cash, the purchase was made on credit). When an accrued liability (such as salaries payable) increases, the related operating expense (salaries expense) on a cash basis decreases. (For example, the company incurred more salaries than it paid.) Decreases in current liabilities have just the opposite effect on cash flows.

Cash Flow Forecasting

By utilizing the indirect method, users can gain a deeper insight into the financial statements of a company and the implications of the changes that have been made in the past. This is because, these non-cash items have previously impacted income statement which https://www.bookstime.com/ it would not have if the net income had been calculated on a cash basis from the beginning. A cash flow statement (CFS) is a financial document that businesses use to measure incoming and outgoing cash and cash equivalents (CCE) over a set period of time.

In this article, we define cash flow statements, the different cash flow methods, cover the pros and cons of each, and explore how automation can improve cash flow. It’s important to note that the two methods for building cash flow statements are only applied to the operating section of the cash flow statement, not the investing or financing sections. As you can imagine, the risk of mistakes on a direct cash flow statement is more significant than on a cash flow statement prepared using the indirect cash flow method. At the bottom of the cash flow statement, the three sections are summed to total a $3.5 billion increase in cash and cash equivalents over the course of the reporting period.

Expenditures Below Net Income

Additionally, any non-cash items such as income tax payment or depreciation should be excluded, as these items do not have an impact on the actual cash flow. This rise in the receivable balance shows that less money was collected than the sales made during the period. Thus, the $19,000 should be subtracted in arriving at the cash flow amount generated by operating activities. The cash received was actually less https://www.bookstime.com/articles/indirect-method-cash-flow-statement than the figure reported for sales within net income. While the direct cash flow method may more accurately reflect your real-time cash flow, the resulting cash flow statement usually doesn’t differ significantly from an indirect statement. This, combined with the added complexity of the direct cash flow method is why most businesses and accountants prefer the indirect method for preparing cash flow statements.

This makes it possible to track and analyze the sources and uses of cash over a period of time. In order to create a statement of cash flows using the indirect method, there are several steps that must be followed. When preparing a cash flow statement, your company also needs to consider any capitalized expenses that would not be included in the income statement. Such expenses include costs of software development, website development, and other expenses related to research and development that should be amortized.

Direct Cash Flow Method

The purchasing of new equipment shows that the company has the cash to invest in itself. Finally, the amount of cash available to the company should ease investors’ minds regarding the notes payable, as cash is plentiful to cover that future loan expense. Advisory services provided by Carbon Collective Investment LLC (“Carbon Collective”), an SEC-registered investment adviser. Go a level deeper with us and investigate the potential impacts of climate change on investments like your retirement account. The common stock and additional paid-in capital (APIC) line items are not impacted by anything on the CFS, so we just extend the Year 0 amount of $20m to Year 1.