JJSF: J & J Snack Foods Corp Stock Price, Quote and News

Contents:

Sign Up NowGet this delivered to your inbox, and more info about our products and services. Invest in stocks like Campbell Soup , Conagra Brands & Atmos Energy to ride out further market volatility caused due to rate hikes, or any expectations related to rate hikes. To buy JJSF stocks in Australia you’ll need to open an account with a broker like Stake. Realtime quote and/or trades are not sourced from all markets.

If you have issues, please download one of the browsers listed here. You may use StockInvest.us and the contents contained in StockInvest.us solely for your own individual non-commercial and informational purposes only. Any other use, including for any commercial purposes, is strictly prohibited without our express prior written consent.

Ex-Dividend Reminder: Autohome, J&J Snack Foods and Tekla … – Nasdaq

Ex-Dividend Reminder: Autohome, J&J Snack Foods and Tekla ….

Posted: Thu, 16 Mar 2023 14:11:00 GMT [source]

You should do your own research before making an investment decision. Past performance is not a reliable indication of future performance. No representation is made as to the timeliness, reliability, accuracy or completeness of the market data provided. Discuss news and analysts’ price predictions with the investor community.

Dippin’ Dots to be acquired by ICEE parent J&J Snack Foods for $222 million

Additional information about your broker can be found by clicking here. Open to Public Investing is a wholly-owned subsidiary of Public Holdings, Inc. (“Public Holdings”). This is not an offer, solicitation of an offer, or advice to buy or sell securities or open a brokerage account in any jurisdiction where Open to the Public Investing is not registered. Securities products offered by Open to the Public Investing are not FDIC insured. Apex Clearing Corporation, our clearing firm, has additional insurance coverage in excess of the regular SIPC limits.

J&J; Snack Foods (JJSF) Q1 2023 Earnings Call Transcript – The Motley Fool

J&J; Snack Foods (JJSF) Q1 2023 Earnings Call Transcript.

Posted: Tue, 31 Jan 2023 08:00:00 GMT [source]

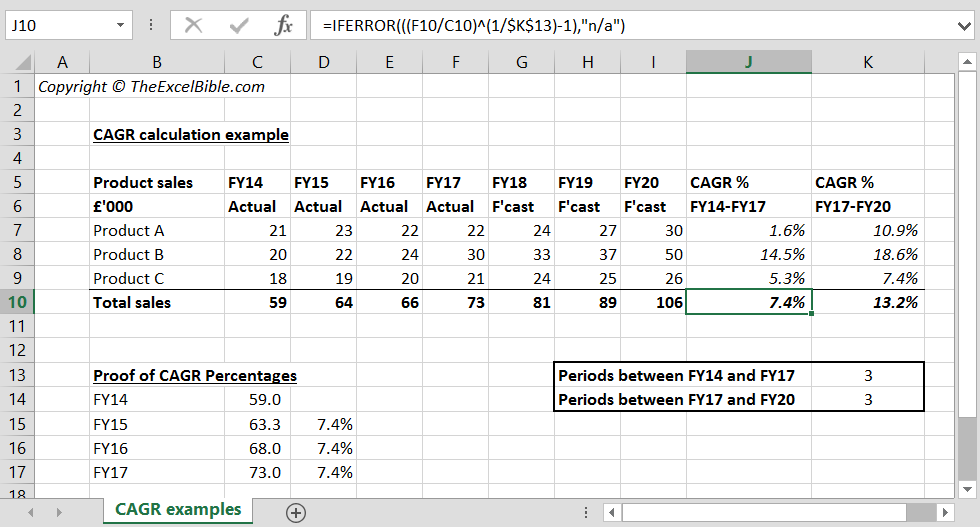

Market Cap is calculated by multiplying the number of shares outstanding by the stock’s price. To calculate, start with total shares outstanding and subtract the number of restricted shares. best penny stocks to watch for march 2021 Restricted stock typically is that issued to company insiders with limits on when it may be traded.Dividend YieldA company’s dividend expressed as a percentage of its current stock price.

What is the 52-week high for JJSF stock?

With December traditionally being a good month for stocks, investing in growth players like Barings BDC , Caterpillar & J & J Snack Foods , to name a few, seems prudent. A roundup of the latest corporate earnings reports and what companies are saying about future quarters. Johnson & Johnson said its second-quarter earnings grew as sales of the company’s new hepatitis C drug continued to boost the health-care giant’s revenue.

This indicates that J&J Snack Foods will be able to sustain or increase its dividend. J&J Snack Foods pays a meaningful dividend of 2.00%, higher than the bottom 25% of all stocks that pay dividends. ICEE and Minute Maid frozen beverage parent J&J Snack Foods Corp. announced Thursday an agreement to buy flash-frozen beaded ice cream maker Dippin’ Dots LLC for $222 million. New seasonal flavor will be available for a limited time only at the world’s largest popcorn franchise retailer PADUCAH, Ky. , Nov. 1, 2022 /PRNewswire/ — Doc Popcorn , the world’s largest fresh-popp… Iconic brands team up to debut fan-favorite cherry and blue raspberry beaded ice to consumers across the country PADUCAH, Ky. , March 1, 2023 /PRNewswire/ — Dippin’ Dots, the original beaded ice crea…

These investments are speculative, involve substantial risks , and are not FDIC or SIPC insured. Alternative Assets purchased on the Public platform are not held in an Open to the Public Investing brokerage account and are self-custodied by the purchaser. The issuers of these securities may be an affiliate of Public, and Public may earn fees when you purchase or sell Alternative Assets. For more information on risks and conflicts of interest, see these disclosures. Intraday Data provided by FACTSET and subject to terms of use.

You can find your newly purchased JJSF stock in your portfolio—alongside the rest of your stocks, ETFs, crypto, and alternative assets. What analysts recommend for JJSF stock, on a scale from 1 to 5. All stock quotes on this website should be considered as having a 24-hour delay. © 2020 Market data provided is at least 15-minutes delayed and hosted by Barchart Solutions. Dividend capture strategy is based on JJSF’s historical data. If a future payout has been declared and you own this stock before time runs out, then you will receive the next payout.

Business Summary

Updated daily, it takes into account day-to-day movements in market value compared to a company’s liability structure. Keep in mind that other fees such as regulatory fees, Premium subscription fees, commissions on trades during extended trading hours, wire transfer fees, and paper statement fees may apply to your brokerage account. Please see Open to the Public Investing’s Fee Schedule to learn more.

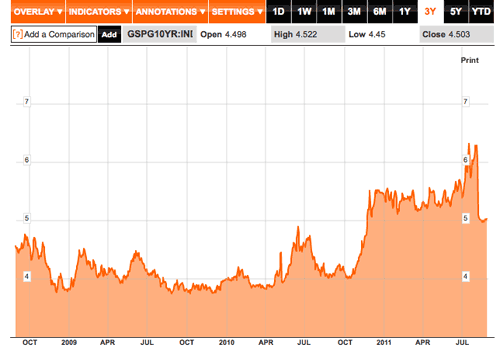

For the last week the stock has had daily average volatility of 2.47%. Discover dividend stocks matching your investment objectives with our advanced screening tools. Schedule monthly income from dividend stocks with a monthly payment frequency. These 25 companies are all privately owned and closely held, and they share a commitment to providing stellar service to customers, offering employees fulfilling, rewarding work and being vital members of their communities. From free snacks in economy class to new business class seats in the front of the plane, here is what to expect from airlines in the coming months. For many, it is exciting to see so many benefits return to service.

NASDAQ: HAIN

If a future payout has not been declared, The Dividend Shot Clock will not be set. Helpful articles on different dividend investing options and how to best save, invest, and spend your hard-earned money. Dow Jones Industrial Average, S&P 500, Nasdaq, and Morningstar Index quotes are real-time. Maintaining independence and editorial freedom is essential to our mission of empowering investor success.

- Grocery stocks The Hershey Company , Conagra Brands , Campbell Soup Company , Ingredion Incorporated and J&J Snack Foods are poised to grow in the coming days.

- For the last week the stock has had daily average volatility of 2.47%.

- Iceland’s food has always been solid, aside from the controversial fermented shark, but the gastronomic choices and the quality of ingredients has never been more simultaneously global and local.

The dividend payout ratio of J&J Snack Foods is 126.13%. Payout ratios above 75% are not desirable because they may not be sustainable. MarketRank is calculated as an average of available category scores, with extra weight given to analysis and valuation. You have already added five stocks to your watchlist. Upgrade to MarketBeat Daily Premium to add more stocks to your watchlist. J&J Snack Foods reported $180.47M in Stock for its third fiscal quarter of 2022.

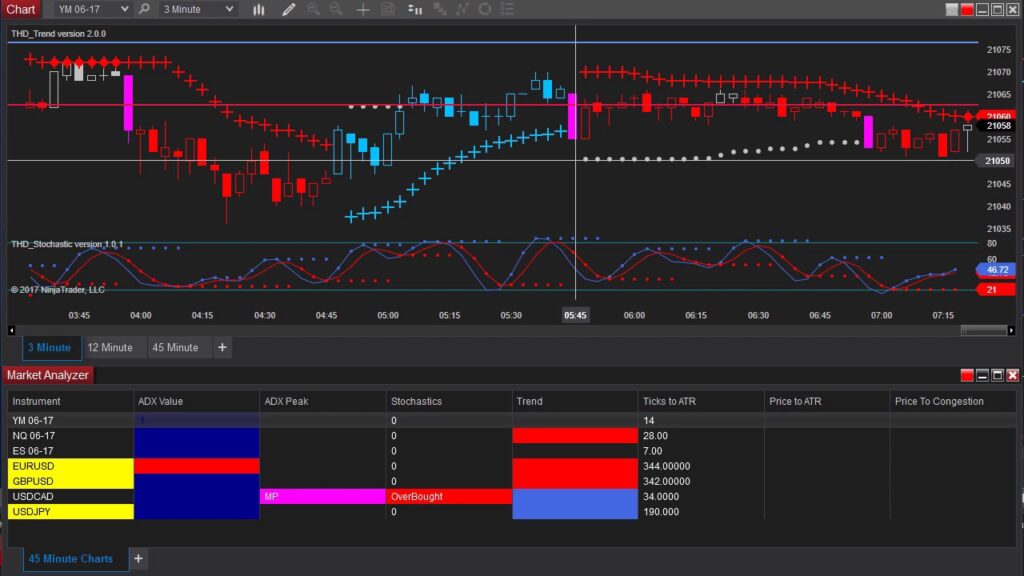

1 Wall Street research analysts have issued “buy,” “hold,” and “sell” ratings for J&J Snack Foods in the last twelve months. The consensus among Wall Street research analysts is that investors should “buy” JJSF shares. The Barchart Technical Opinion widget https://day-trading.info/ shows you today’s overally Barchart Opinion with general information on how to interpret the short and longer term signals. Unique to Barchart.com, Opinions analyzes a stock or commodity using 13 popular analytics in short-, medium- and long-term periods.

Real-time quotes, advanced visualizations, backtesting, and much more. Learn more about our full range of powerful features including the best charts on the web. To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research. 22 employees have rated J&J Snack Foods Chief Executive Officer Gerald B. Shreiber on Glassdoor.com. Gerald B. Shreiber has an approval rating of 83% among the company’s employees. Sign-up to receive the latest news and ratings for J&J Snack Foods and its competitors with MarketBeat’s FREE daily newsletter.

WallStreetZen does not provide financial advice and does not issue recommendations or offers to buy stock or sell any security. J&J Snack Foods stock was originally listed at a price of $8.19 in Dec 31, 1997. If you had invested in J&J Snack Foods stock at $8.19, your return over the last 25 years would have been 1,645.54%, for an annualized return of 12.12% . Grocery stocks The Hershey Company , Conagra Brands , Campbell Soup Company , Ingredion Incorporated and J&J Snack Foods are poised to grow in the coming days. Live educational sessions using site features to explore today’s markets.

Other market data may be delayed by 15 minutes or more. JJSF, +0.62% said late Thursday its board has declared a quarterly cash dividend of 70 cents a share, payable on Oct. 11 to shareholders of record as of Sept. 19. The Barchart Technical Opinion rating is a 56% Sell with a Weakest short term outlook on maintaining the current direction. All investments involve the risk of loss and the past performance of a security or a financial product does not guarantee future results or returns.

Results are interpreted as buy, sell or hold signals, each with numeric ratings and summarized with an overall percentage buy or sell rating. After each calculation the program assigns a Buy, Sell, or Hold value with the study, depending on where the price lies in reference to the common interpretation of the study. For example, a price above its moving average is generally considered an upward trend or a buy. Brokerage services for alternative assets available on Public are offered by Dalmore Group, LLC (“Dalmore”), member of FINRA & SIPC. “Alternative assets,” as the term is used at Public, are equity securities that have been issued pursuant to Regulation A of the Securities Act of (“Regulation A”).